Millennial Money Mastery:Are you a millennial looking to take control of your finances and secure your financial future? Look no further! In this comprehensive guide, we’ll share 10 essential money mastery tips specifically tailored to millennials. Whether you’re just starting your career or already well-established, these expert tips will empower you to master your money and achieve financial independence. Millennial Money Mastery

- Start Early: One of the most powerful advantages millennials have is time. Start investing early to take advantage of compound interest and maximize the growth potential of your investments over time.

- Create a Budget: Establish a monthly budget to track your income and expenses. Allocate your funds wisely, prioritizing essential expenses while also setting aside money for savings and investments.

- Pay Yourself First: Make saving a priority by paying yourself first. Set up automatic transfers to your savings and investment accounts each month before allocating funds to other expenses.

- Build an Emergency Fund: Prepare for unexpected expenses by building an emergency fund. Aim to save enough to cover three to six months’ worth of living expenses in case of job loss, medical emergencies, or other unforeseen circumstances.

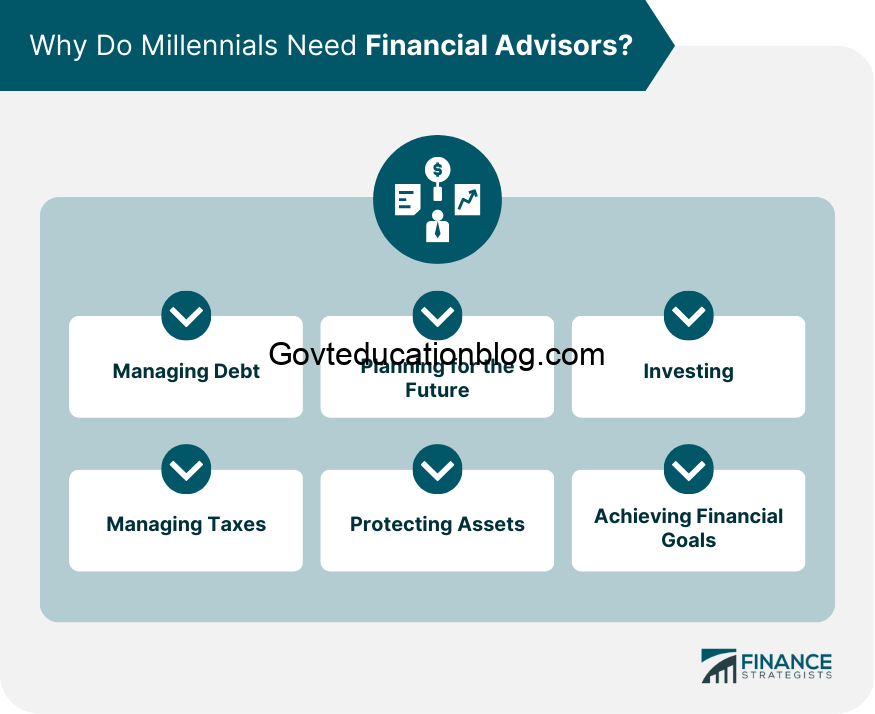

- Manage Debt Wisely: Be strategic about managing your debt. Prioritize high-interest debt repayment while also taking advantage of low-interest rates to invest in your future.

- Invest in Your Future: Take advantage of employer-sponsored retirement plans such as 401(k)s and individual retirement accounts (IRAs). Contribute regularly and consider diversifying your investments to minimize risk.

- Educate Yourself: Invest in your financial education by reading books, attending workshops, and seeking advice from trusted financial advisors. The more you know about personal finance, the better equipped you’ll be to make informed decisions about your money.

- Avoid Lifestyle Inflation: As your income increases, resist the temptation to inflate your lifestyle. Instead, focus on saving and investing the extra income to build long-term wealth.

- Protect Your Assets: Ensure you have adequate insurance coverage to protect yourself and your assets against unforeseen events such as accidents, illness, or property damage.

- Plan for the Future: Create a long-term financial plan that aligns with your goals and aspirations. Whether it’s buying a home, starting a family, or traveling the world, having a clear roadmap will help you stay on track and make progress towards your objectives.

Millennial Money Mastery Conclusion’s

Conclusionon Millennial Money Mastery: Mastering personal finance is essential for millennials to achieve financial independence and secure their future. By following these 10 essential tips, you can take control of your finances, build wealth, and achieve your long-term goals. Remember, financial success is not about how much you earn but how well you manage and invest your money. Start implementing these tips today and pave the way for a brighter financial future. these thing you should remember for Millennial Money Mastery.

Read More on other topic: Read 1, Read 2 (not same related topic of Millennial Money Mastery)

This comprehensive guide to personal finance for millennials empowers you with the knowledge and tools needed to take control of your financial destiny. Take the first step towards financial freedom and start mastering your money today!

Additional Tips on Millennial Money Mastery:

- Invest in Yourself: Consider furthering your education or acquiring new skills that can increase your earning potential. Investing in yourself is one of the best investments you can make for long-term financial success.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings or investment accounts. This ensures that you consistently save money without having to think about it.

- Monitor Your Credit Score: Your credit score can have a significant impact on your financial future. Regularly monitor your score and take steps to improve it by paying bills on time and keeping credit card balances low.

- Avoid Lifestyle Inflation: As your income increases, resist the temptation to inflate your lifestyle proportionally. Instead, save or invest the extra money to secure your financial future.

- Prepare for Emergencies: Build an emergency fund to cover unexpected expenses like medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

- Negotiate Your Bills: Don’t be afraid to negotiate with service providers like cable companies or insurance companies for better rates. You’d be surprised how often they’re willing to offer discounts to keep your business.

- Stay Informed: Keep yourself informed about financial news and trends. Understanding the market can help you make smarter investment decisions and adapt to changing economic conditions.

- Diversify Your Investments: Spread your investments across different asset classes to reduce risk. Diversification can help protect your portfolio from market downturns and maximize long-term returns.

- Set Financial Goals: Whether it’s buying a home, starting a business, or retiring early, set clear financial goals and create a plan to achieve them. Having specific goals can help you stay motivated and focused on your financial journey.

- Seek Professional Advice When Needed: If you’re unsure about certain financial decisions or need help with complex matters like taxes or investments, don’t hesitate to seek advice from a financial advisor. Their expertise can provide valuable guidance tailored to your individual circumstances.

By implementing these additional tips alongside the original ten, millennials can further strengthen their financial foundation and set themselves up for long-term success.